Investment Property - A Guide to Smart Investing

Investing in real estate is one of the most proven and reliable ways not only to preserve your capital but also to grow it over time. An investment property is a tangible asset, something you can physically touch, that, when managed properly, can become a dependable source of steady income.

What Exactly Is Investment Property, and How Does It Differ from Your Home?

The key difference lies in the purpose of purchase. When choosing an investment property, your main criteria aren’t emotional connection or personal comfort - it’s the financial potential: how profitable it will be in the long run.

Simply put, this is a property that “works” for you. It generates income in two main ways:

Rental Income: The owner rents out the property and receives regular cash flow.

Capital Appreciation: The owner buys the property with the expectation that its value will increase over time, allowing it to be sold later at a higher price.

It’s this dual benefit that makes investment real estate such an attractive asset.

To take your first steps in this world with confidence, let’s first explore the different types of investment properties and determine which one aligns best with your goals.

Types of Real Estate Investments You Should Know

Investment real estate is often associated with the residential segment, but its scope and potential are much broader. The market offers a wide spectrum of assets, each with its own characteristics, risk profile, and return potential. To make a sound, informed decision, it’s important to examine each major category in detail and understand its specific features.

1. Residential Property

The residential segment is the most significant part of the investment real estate market. In Georgia, the vast majority of property transactions fall into this category, making it highly liquid and consistently attractive to a wide range of investors. For nearly 70% of investors, this type of investment property is considered the primary and most time-tested strategy for capital growth.

Its appeal is driven by several key factors. First and foremost is the consistently high demand for housing, which directly translates into stable rental income. Based on recent years’ data, the average annual rental yield in Georgia’s major cities remains at 8-9%, positioning it as a far more profitable alternative compared to bank deposits.

Alongside rental income, off-plan (under-construction) apartments offer particularly strong capital appreciation potential, as their value typically increases significantly by the time the project is completed. The combination of these factors makes residential property a well-balanced, relatively low-risk asset, ideal for both beginner and experienced investors alike.

2. Commercial Property

Commercial investment property refers to spaces where businesses operate and grow, whether it’s an office, shop, hotel, or café. The success of this type of asset is directly tied to the country’s economic activity.

A clear example is the recent trend in Georgia: record numbers of newly registered companies and incoming tourists have significantly increased demand for offices, retail spaces, and hotels.

As a result, commercial properties typically generate higher rental income. However, they also require greater investor involvement and a deeper understanding of the market to manage effectively.

3. Land Plots

Land is a unique category of investment property that, unlike residential or commercial assets, is not designed to generate regular cash flow. Its primary, and often only, investment potential lies in the future appreciation of its value.

The effectiveness of this strategy is clearly reflected in the urban development dynamics of Georgia’s cities. For example, large-scale infrastructure projects in the outskirts of Tbilisi or along the Black Sea coastline have driven significant increases in land prices.

This makes land an attractive choice for strategic and patient investors who prioritize long-term value growth over immediate returns.

4. Mixed-Use Developments

This is one of the most strategic models in modern real estate investment, combining residential, commercial, and recreational segments within a single architectural concept. Such projects offer investors a unique built-in mechanism for naturally hedging risks.

The key appeal lies in diversifying income sources. Imagine your capital generating revenue simultaneously from the steady rental of residential units and from commercial spaces located within the same building.

Tbilisi’s development market has embraced this trend, as today’s buyers are increasingly drawn to apartments that offer both comfort and convenient infrastructure in one place. This sustained appeal ensures consistently high demand for such properties.

As we can see, there’s no one-size-fits-all answer to the “ideal” investment property type. Whether your priority is the stability of residential real estate, the higher returns of commercial assets, or the long-term potential of land, your choice should ultimately reflect your goals and capabilities.

What matters most is making a well-informed decision, because it’s this approach that turns real estate into a successful and profitable investment.

Advantages of Real Estate Investment

Now that we’ve explored what investment property is and the different forms it can take, it’s time to take a closer look at its key advantages, the very reasons why, for generations, real estate has been considered one of the smartest and most reliable strategies for building and preserving wealth.

Stable Passive Income

This is one of the most tangible benefits of real estate investment. By renting out a well-chosen apartment, you generate a steady monthly cash flow that not only covers property maintenance expenses but also provides you with additional income. In a dynamic city like Tbilisi, where demand from both local and international professionals, as well as students, remains consistently high, quality residential properties rarely stay vacant for long.

Capital Growth and Protection Against Inflation

Money left idle in a bank account inevitably loses value over time due to inflation. Real estate, on the other hand, is a tangible, physical asset whose value typically increases in the long term. This means your property not only generates income but also protects your capital from devaluation while steadily increasing its worth.

Financial Leverage and Accessibility

Many people assume they need the full purchase price in hand to invest in real estate. In reality, one of the unique advantages of property investment is the ability to use financial leverage, making entry into the market far more accessible.

Today, there are two main tools for this. The first is a bank mortgage, where you pay only a portion of the property’s price upfront, typically 20–30% as a down payment, while the bank covers the rest through a loan, making you an immediate owner. The second, equally popular method, is the flexible payment plans offered by reputable development companies, such as in-house installment options for apartments in Tbilisi. These models are often more flexible and frequently interest-free, allowing you to spread the remaining payments over the construction period after the initial deposit.

These mechanisms make investment property accessible to a much wider audience, giving you the unique opportunity to start building your capital with minimal initial costs.

Choosing the Right Investment Property - Key Factors to Consider

Once you’re familiar with the advantages of real estate investment, the most critical step follows: making a strategically sound choice. Here are four fundamental factors you should carefully evaluate before making a decision.

Location – The Golden Rule #1

Location remains the single most important criterion in real estate. But a “good” location doesn’t just mean a prestigious neighbourhood; it’s about accessibility to essential infrastructure. Consider how close the property is to educational institutions, shopping areas, and recreational spaces. In Tbilisi, for example, apartments near such amenities tend to rent out 15–20% faster and at higher rates.

Neighbourhood’s Future Development Potential

Don’t evaluate a location solely based on its current state - think ahead. Research upcoming development plans in the area. Is there a new park, road expansion, or shopping center planned? Neighborhoods with large-scale infrastructure projects in the pipeline often see a significant boost in property value, making them particularly appealing to investors.

Developer’s Reputation and Construction Quality

If you’re purchasing in a new development, your investment’s success depends heavily on the developer. Review their track record, visit completed projects, and assess construction quality. A trustworthy developer ensures adherence to deadlines and uses high-quality materials, ultimately safeguarding your investment and preserving its long-term value.

Project Concept and Functionality

A successful investment property meets the needs of modern living. This means not only functional and comfortable layouts but also added value through project amenities, such as landscaped courtyards, advanced security systems, or convenient parking. These features create an attractive living environment and directly increase rental potential.

Premium Real Estate Opportunities by Materia

For years, Materia has been shaping the real estate market with projects that combine distinctive architecture and the highest construction standards. The company’s core values center on respect for the environment, harmonious integration with the natural landscape, and the creation of spaces that merge aesthetics, functionality, and long-term value.

Real estate from Materia is especially appealing to those who are looking for a stable, high-quality asset. Each project is distinguished by a prime location, well-developed infrastructure, and the use of premium materials - qualities that make these properties equally attractive for living, renting, and capital appreciation.

Outlook Forest

Among Materia’s flagship developments is Outlook Forest - a premium-class residential project located in one of Krtsanisi’s greenest, most peaceful, and prestigious neighbourhoods. Spanning 70,000 sq.m, the project incorporates everything needed for modern, comfortable, high-quality living.

At its heart stands a 28-story tower housing 250 premium apartments, designed with functional layouts and contemporary interiors. But Outlook Forest is more than just a residential complex - it features a multifunctional infrastructure, including a 9-story luxury hotel, commercial spaces, co-working and leisure zones, a swimming pool, and a fitness center.

Construction is now in its final phase, with the facade completed and full delivery scheduled for December 2025. Outlook Forest is particularly attractive for investors looking for a high-end property in an exceptional location, set within a cozy and eco-friendly environment, equally suitable as a personal residence or a strong investment asset.

Tabakhmela Estates

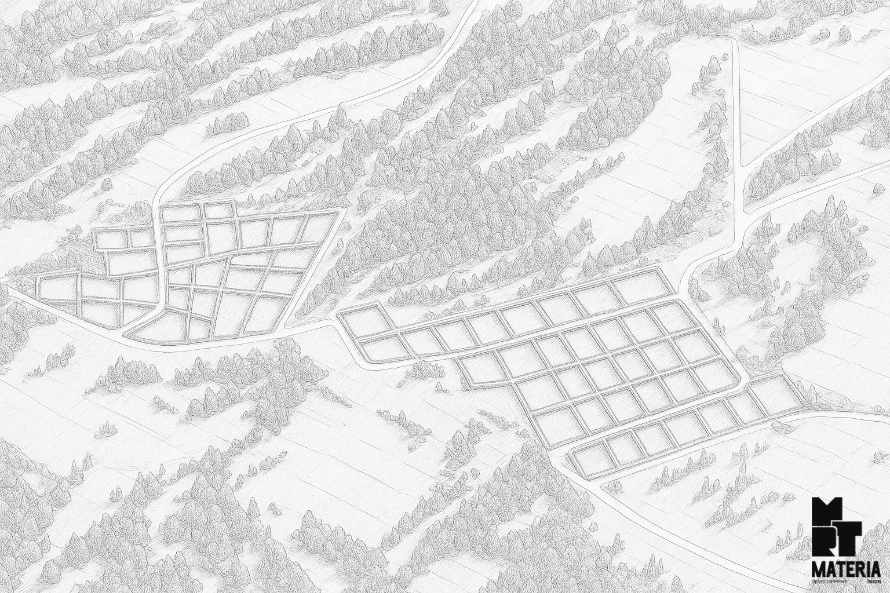

Another standout project from Materia is Tabakhmela Estates, which introduces an entirely new residential concept for those seeking to build a home away from the city’s noise, in an eco-friendly and green setting.

Spread across 8 hectares, the project offers private land plots ranging from 600 to 1,500 sq.m, all supported by fully developed infrastructure. Residents benefit from internal roads, full utility connections, 24/7 security, and landscaping maintenance services - creating a clean, safe, and prestigious environment just minutes from Tbilisi.

Investing in Tabakhmela Estates means more than acquiring land in a sought-after suburban area. It’s about owning a premium-class asset supported by ready-made infrastructure, with steadily growing value over time.